Start-ups and

Financing

Start-ups in North Rhine-Westphalia

Every new biotech company starts with an idea. The subsequent development requires a combination of expert knowledge, stimulation, organization, as well as the right answers to many questions on company development, legal foundations, and intellectual property.

BIO.NRW supports founders and scientists in the Biotech Network NRW through the transfer of knowledge, supporting start-ups from their academic beginnings up to company founding. In this process strong collaboration partners are as important as the access to an excellent biotech network that puts NRW on the global map.

more information on this topic

Starting up in NRW

8 steps on the way to a successful Start-up

Step I. Writing the business plan

|

The value of a business plan simply cannot be overstated. Most investors look through more than a hundred plans every year and you now must catch the reader‘s interest, otherwise, you may not even make it to the initial analysis round. Therefore, it is imperative that your business plan is well prepared and provide the target audience with confidence that your technology will lead to revenue, pro t, and a significant market share. |

Step II. Building up a network

|

Here is a small overview of useful information to guide you through the first steps of setting up your own business in Nord Rhine-Westphalia. BIO.NRW is a great community to help you with, networking, advice, business plan advisory, founder competitions and can recommend consultants, marketers, accountants, lawyers, patent attorneys and funders. |

Step III. Setting up the company

|

To minimize personal liability, it is a good idea for start-ups within the life sciences to either set up a GmbH, a company with limited liability or a Unternehmergesellschaft – UG – a “small” company with limited liability. The minimum capital for a GmbH is Euro 25.000, and the minimum capital for a UG is Euro 1. Establishing a GmbH may require more money upfront, but often the increased financial credibility pays off. “There was a time when the English private limited company (Ltd) was fashionable, but since the UG exists, the English Ltd. or other foreign vehicles are much less attractive,” says Dr. Kracht, attorney at Kracht+Strohe Rechtsanwälte. |

Step IV. Find a legal advice

|

A good lawyer will become a key advisor in the early stages of your company, so it is crucial to seek out quality legal advice in the field of your startup. Some large law firms have special incentives for start-ups, often with fees deferred until a funding event happens. In terms of company formation, make sure you choose the company structure that ts your business model best. Your intellectual property (IP) is one of your most valuable assets, so make sure you secure it early and well. If you are filing your own patent, craft the claims so that your technology is protected as broadly as possible; if you are licensing IP (for example, from a university), do this early and seek your lawyer‘s counsel to make sure the license terms are acceptable. |

Step V. Engage a cofounder

|

When starting a company, find one or more co-founder(s) with complementary skill sets. If you are a cancer biologist and your business idea is to develop new cancer therapeutics and someone with pharmacology or drug development experience. If you have a clinical background and are developing a medical device, find an engineer. Having a co-founder has multiple benefits, from expanding the company‘s skillset, to having a sounding board and accountability partner. |

Step VI. Build the right team

|

A strong team with the best people you can recruit is a key asset for a startup. Faculty cofounders mostly remain involved as advisors or board members. If your team is made up of academics, it can be extremely helpful to find an experienced entrepreneur or executive with startup experience. A youthful team is great, but an experienced person will help to give you credibility in front of investors. |

Step VII. Use incentives

|

At the very early stage, you will not have the funding needed to pay any salary. The solution is to give cofounders and investors equity or shares in your company tied to a vesting schedule, allowing your cofounders and early employees to participate in the ownership of your company. Initially, these company shares will be worth very little, but the idea is to incentivize high-quality work that will drive up the value of the shares with a large upside to the shareholders. Equity is also a way to recruit an experienced entrepreneur, senior advisor, or consultant with unique expertise to your company. |

Step VIII. Financing

|

Financing is probably the greatest risk companies face in their early stages. A common feature of successful biotech’s has been their financing strategies and the investment from VCs. The earlier you can get VC backing or private equity from business angels, the greater your chances of success. Bringing in VCs or private equity from experienced investors gives you access not only to cash but also to advice, information, market knowledge and networks. The investors can help you build the company, make it more financially attractive to other potential investors and increase the chances of your company going public. Essentially, the VC acts as a founding partner and gives you a solid financial platform from which to build your company. Research your investors before meeting with them. Find out what their investment interests are and in which space they usually participate. This will help you tell your story appropriately, in terms of specific amount to ask for and your use of the funds. |

Financing innovation in life sciences

Business Angel Network NRW

The BIO.NRW Business Angel Network supports innovative life science start-ups directly at university, promising young companies, as well as international biotech/life science companies that intend to settle in NRW. Besides financing founders, BIO.NRW Business Angels also provides support in the subsequent financing of established companies that are looking to take the next step in their development. With its know-how, contacts, and capital, they are a decisive factor for a successful start in business.

EIT Health Investors Network

The European project EIT Health is one of the world’s largest initiatives (Public Private Partnership) in health and focusses on the EU development of this industry. More than 140 parties from the fields of pharma and medicinal technology as well as scientific institutes and universities lend their expertise to this network.

An essential tool of this network is the platform startups4.eu, which facilitates the mutual exchange between founders and investors and makes it easy to set up a first encounter.

Investor circle and international BIO.NRW Business Angel Congress

As part of the BIO.NRW Business Angel Network, both founders and young companies have access to strictly confidential investor circles (BIO.NRW Business Angel Circle) five to six times a year. This is a presentation platform that offers the chance to pitch ideas to a hand-picked selection of investors (private, development banks, VC, corporate venture) and to find funding. To date, more than 200 start-ups, founders, as well as SMEs used the opportunity to present their business models in a professional and confidential setting and subsequently discuss them.

Besides the Business Angel Circle Meetings, BIO.NRW organizes the international Business Angel Congress each year in March. This congress focusses on investors and companies and offers a platform for sharing ideas and discussing current developments in the world of European life science finance. Young biotech companies are coached together with experienced business developers, and alternative financing models discussed. You can find more information about this Business Angel Congress here.

Funding opportunities

The value of innovation is not calculable. Therefore, small and medium enterprises (SMEs) in particular face the challenge of realizing innovative projects that carry substantial financial risks.

A broad range of public funding opportunities is in place, but not all are suited to special projects, and a potential subsidy for companies is never guaranteed completely. Therefore, a company should always embed development subsidies into their overall strategy. To provide a better overview, the BIO.NRW The Home of Biotech North Rhine-Westphalia publishes the state’s first development opportunity overview in life sciences, together with Zenit GmbH/NRW.Europa.

More information in this

brochure (DE)

Basic funding types

Funding programs share several similar funding conditions among them.

They can be divided into the following basic types of programs:

- Grant programs

- Development loan programs

- General support programs

- Equity or risk capital

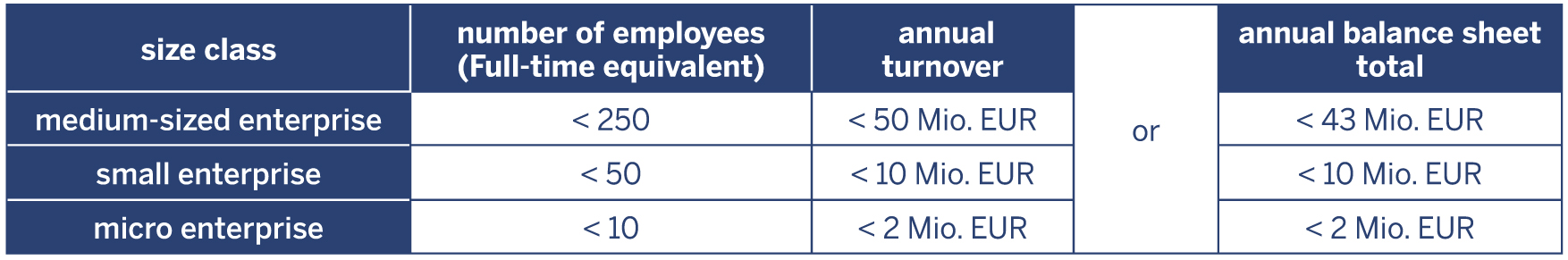

To make a claim for funding through a certain program, the company should meet the definition of SME companies used by the EU commission. The criteria are as follows:

The funding bodies, the State of North Rhine-Westphalia, the Federal Government, and the EU strive for different economic and social objectives with their funding programs. These political guidelines are also used by funding bodies to assess project applications. A neutral initial assessment of project ideas can be provided by NRW.Europa as an information center. It is possible to request an initial assessment in a meeting or via submitted business draft free of charge and at any time.

NRW.Europa Hotline

ZENIT GmbH

Phone: 0208 30004-2020

NRW.Europa Hotline

EU- und Außenwirtschaftsförderung der NRW.BANK

Phone: 0211 91741-4000

www.nrweuropa.de

More information in this

brochure (EN)